Setting Up Your IRS Online Account and Giving Access to Your CPA

Managing your taxes can be complex, but with the right tools and professional support, it doesn't have to be overwhelming. One essential tool that can simplify your tax management is the IRS online account. This account allows you to securely access your tax information, make payments, and, importantly, approve requests like the Tax Information Authorization (TIA) from your accountant.

In this article, we'll guide you through setting up your IRS online account and approving your accountant's TIA request. This will enable your accountant to efficiently manage your tax information, ensuring your taxes are handled promptly and accurately.

Why Set Up an IRS Online Account?

The IRS online account offers a range of benefits, including:

- Secure Access to Your Tax Information: View your tax balances, payment history, and key documents.

- Payment Options: Easily make and track payments online.

- Efficient Communication: Receive updates and communicate securely with the IRS.

- Authorization Management: Approve requests like TIA from your accountant to allow them to access your tax information.

Step 1: Gather the Necessary Information

Before you begin, make sure you have the following:

Email Address

Driver's License (or other state-issued ID or your passport)

Your Phone (to take photos of your license and a selfie)

Your social security number

Step 2: Create Your IRS Online Account

1. Visit the IRS Website to Create Account:

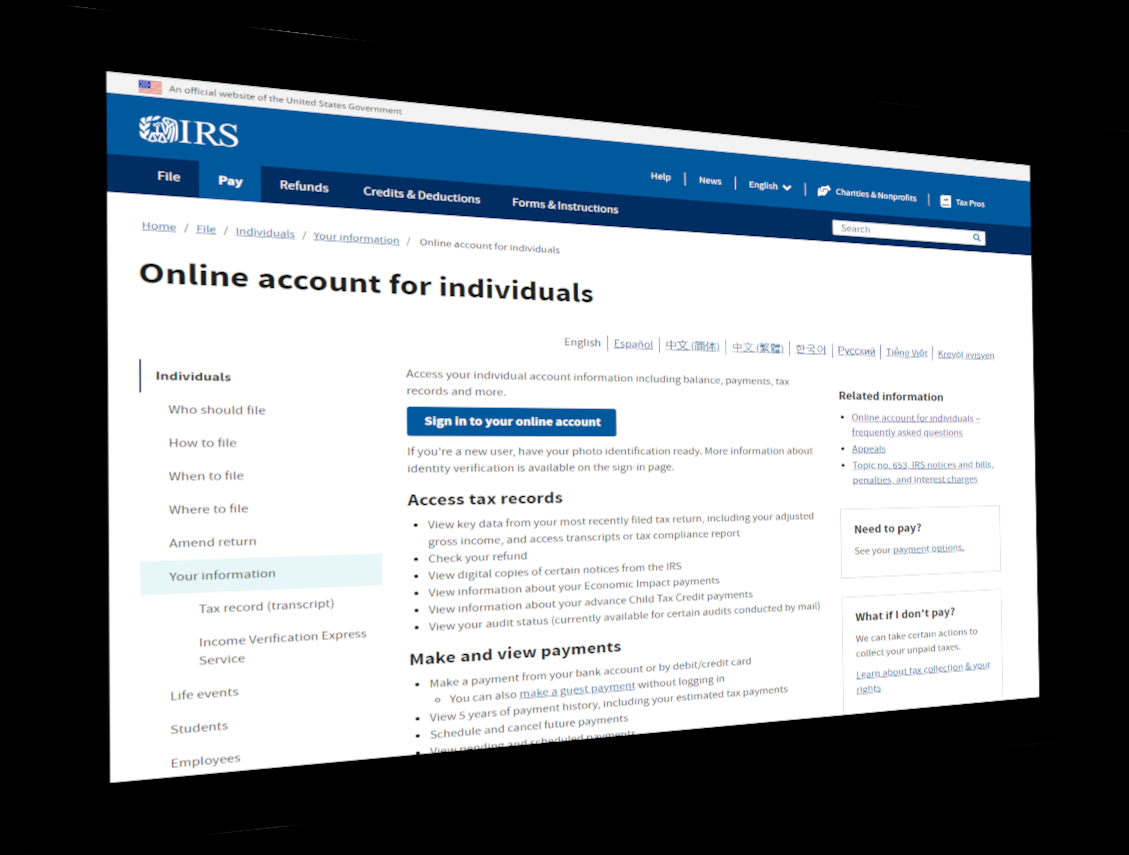

- Go to the IRS Online Account for Individuals page

- Click or tap 'Sign in to your online account'

- Click or tap 'ID.me Create an account'

- Enter email address, create a password, check the appropriate boxes, and click or tap 'Create account'

2. Confirm Your Email:

- Check you rinbox for a confirmation email from ID.me and click or tap the confirmation link

3. Choose a Multi-factor Authentication Method:

- Select your preferred method (we recommend text message)

4. Verify Your Identity:

- Select the self-service method

- A link will be sent to your phone via text message

- Follow the link and follow the instructions to upload your driver's license and take a selfie

- Enter your Social Security Number

5. Verify Your Information:

- Review the information you've entered and confirm it's correct

- Your IRS Individual Online Account is now set up

Step 3: Accept the TIA Request from Your Accountant

1. Inform Your CPA:

- Let your CPA know that your IRS online account is set up and ready to go

2. Wait for CPA to request authorization:

- Next, your CPA needs to log into their IRS Tax Pro account to make the TIA request (at Sonny Peak CPA, LLC, we will let you know by email)

3. Log in to your IRS Online Account:

- Once your CPA lets you know that they have made the authorization request, log in to your account with your credentials (Make sure to bookmark https://www.irs.gov/payments/online-account-for-individuals to make it easy to find next time!)

3. Approve the Request:

- At the top right of the page, click or tap on 'Authorizations' then click 'Approve/Reject'

- Review the details, check the appropriate boxes, and click or tap 'Approve Request' to finalize

- Your CPA's authorization request is now approved

Final Thoughts

Setting up your IRS online account and approving your accountant's TIA request is a crucial step in ensuring your taxes are managed efficiently. With these tools in place, you can have peace of mind knowing that your tax information is accessible and that your accountant can act on your behalf to address any tax-related issues promptly.

If you haven't set up your IRS online account yet, take the time to do so today. It's an investment in your financial well-being, making tax management easier and more secure.

For assistance with your IRS Online Account or any other related issues, don't hesitate to reach out.