Most of what you hear about S-corp "15 percent tax savings" is wrong or oversimplified.

Information & Inspiration

When someone dies owning appreciated assets, like real estate, stocks, or a business, the tax law gives heirs a powerful benefit: stepped-up basis.

Ever tried to drive a screw with a hammer, or tighten a nail with a wrench? Of course not. That's exactly what bad accounting habits look like to us as a CPA firm — painfully obvious. But to many contractors, it's not so apparent. That's why we're calling these "obvious" habits: they're the kind of things that are second nature...

There's a lot of hype around "writing everything off" using 100% bonus depreciation. Some of it's technically true—but most of it is misleading, especially from social media tax influencers, and misunderstood by business owners.

On June 24, 2025, Melio announced it would be acquired by Xero in a transaction valued at:

BOI is Dead

It Looks Like the BOI Saga is Finally Over

AR in Accounting?

No, not Accounts Receivable... Augmented Reality.

Everyone loves to argue about what's happening in Washington, D.C., but let me warn you—many real changes that affect your daily life are happening much closer to home. The Maryland General Assembly's 2025 legislative session is in full swing, and it's a whirlwind of new laws waiting to land on your doorstep.

A Reflection: Fighting for Simplicity and Clarity in Regulations is an Ethical Imperative for CPAs

As I reflect on my work and the challenges CPAs like me face, I can't help but feel overwhelmed by the complexity and confusion embedded in the regulatory environment. It seems like we're constantly dealing with a system that's needlessly complicated—one that forces us to navigate endless rules, shifting requirements, and inconsistent enforcement....

QuickBooks has introduced an update for users of QuickBooks Payments that streamlines how invoices are handled and paid. As of October 21, a new option has been available, allowing payors to cover a convenience fee when paying an invoice by ACH bank payment—even if the invoice isn't enabled for other online payment methods. Keep reading to find out...

The IRS has announced updates for 2025 retirement contributions to keep pace with inflation:

Starting December 31, 2024, QuickBooks Online Payroll will change how it handles automated payroll taxes for businesses in Maryland and other states that haven't seen this shift yet. Instead of making payroll tax payments on their due dates, QuickBooks will now withdraw payroll taxes every time you process payroll or adjust amounts owed.

There's a growing trend among small businesses to rush into hiring a CFO, either in-house or through a virtual service, believing it's the key to leveling up. However, most small businesses—especially those under $10 million in revenue—don't need a CFO yet. What they do need is solid controllership. Everything in finance begins with accurate...

Running a small business means you need a basic understanding of accounting to make informed financial decisions. While accounting can seem complicated, mastering a few key concepts will help you keep track of your business's performance and avoid costly mistakes. In this post, we'll cover the essentials—double-entry accounting, accrual vs. cash...

UPDATE: As of 3/21/2025, the BOI reporting requirement has been removed for U.S. companies and U.S. persons! (However, it still remains in effect for entities formed under the laws of foregin countries.)

As a business owner in Maryland, it's crucial to stay ahead of changes in labor laws, especially when they affect how you manage your workforce. Two new laws, passed during the 2024 General Assembly session, will take effect on October 1, 2024, that you need to be aware of: the Pay Transparency Law and the Pay Stub and Pay Statement Law...

In today's fast-paced business environment, managing finances effectively is key to success. QuickBooks Online (QBO) is a powerful tool designed to streamline accounting tasks. Here's why starting with QBO makes sense for your business, along with a crucial tip for maximizing its benefits.

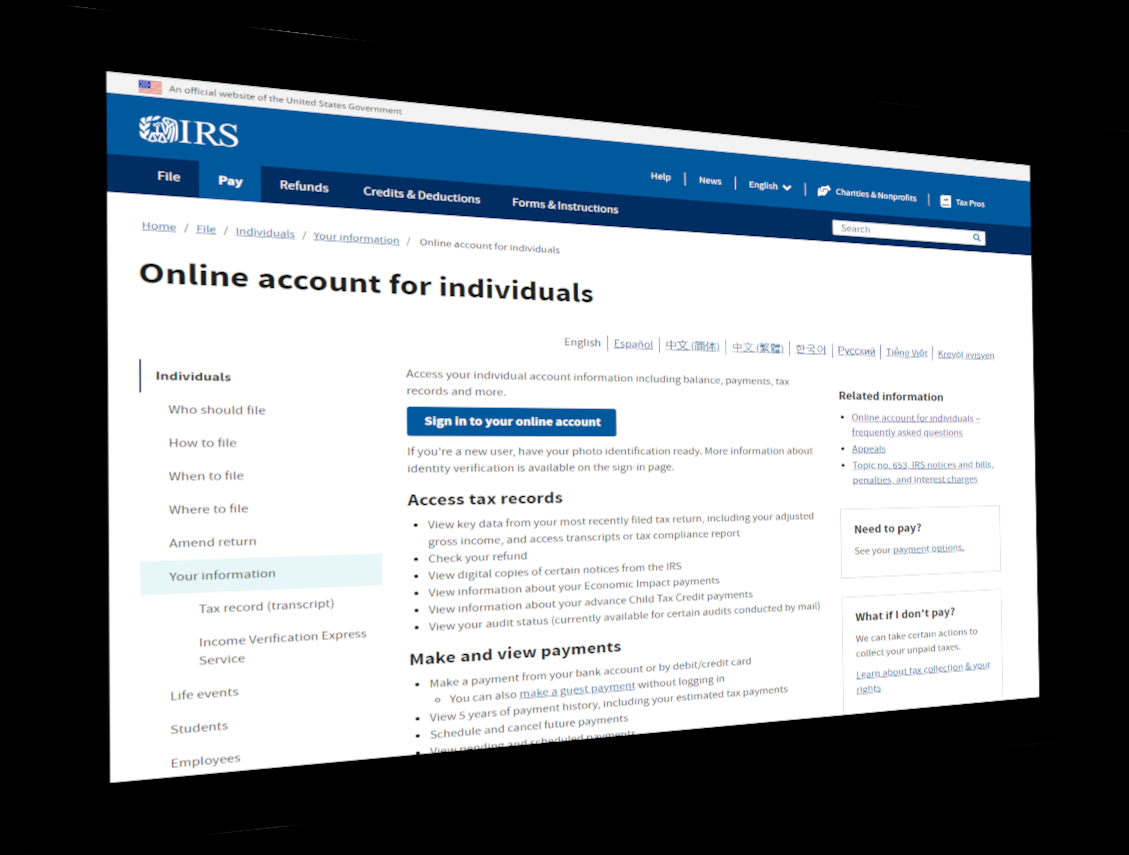

Managing your taxes can be complex, but with the right tools and professional support, it doesn't have to be overwhelming. One essential tool that can simplify your tax management is the IRS online account. This account allows you to securely access your tax information, make payments, and, importantly, approve requests like the Tax Information...

Maintaining your business's good standing status is essential for legal and operational health. Here's why it's critical and what risks are involved if you don't comply.

Blog posts may contain affiliate links. See our disclosure about affiliate links here.